The PA Budget: A Disgrace and Dereliction of Duty

FOR IMMEDIATE RELEASE June 25, 2021 Contact: Adrienne Standley standley@pennbpc.org 717-805-8466 Statement by Marc Stier, Director, Pennsylvania Budget and...

read more

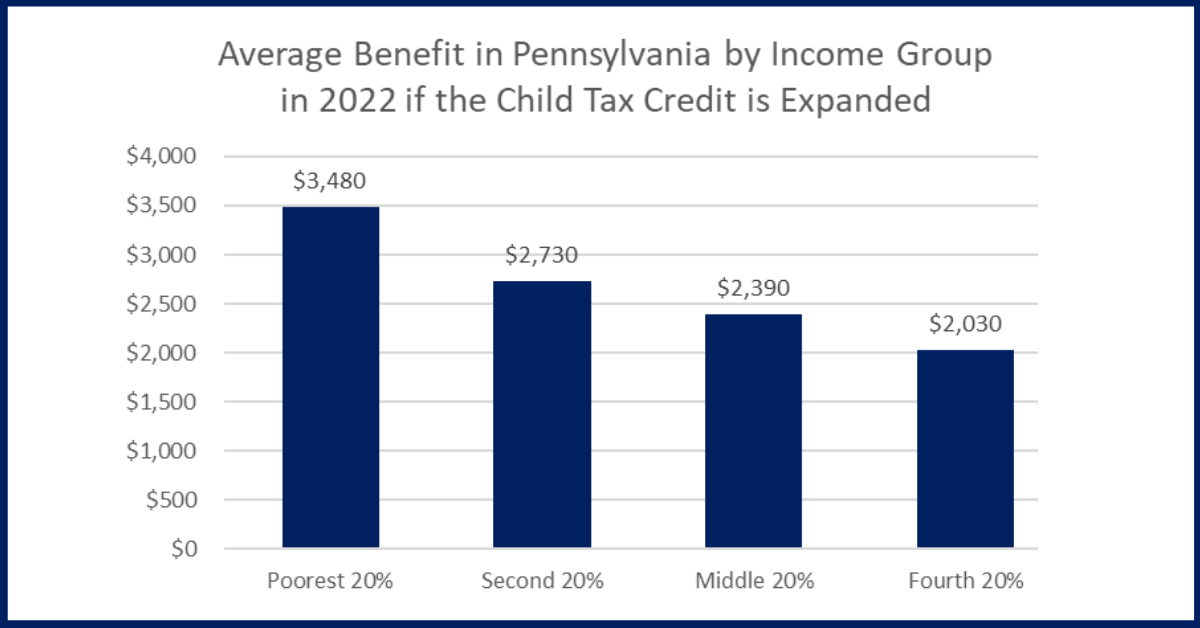

This Is What Permanent ARP / AFP Child Tax Credit Changes Would Do for Pennsylvanians

The American Rescue Plan (ARP) has made significant changes to federal tax policy, expanding and strengthening the child tax...

read more

We The People – PA: People’s Budget Statewide Roll-Out and Town Hall

A budget is a moral document; it is a statement of our values and priorities. We The People –...

read more

Expanding the Child Tax Credit as Part of Biden’s American Rescue Plan Would Reduce Poverty in PA

President Biden’s first COVID-19 relief proposal—the American Rescue Plan—includes a significant expansion of the child tax credit (CTC), increasing...

read more

A State EITC Could Help Fix PA’s Upside-Down Tax System

If one thing has become clear during the COVID-19 pandemic, it is that workers who do essential work—like providing...

read more

REPORT: Why Pennsylvania Needs a State Earned Income Tax Credit (EITC)

If one thing has become clear during the COVID-19 pandemic, it is that workers who do essential things like providing care...

read more

A Statement on HB 1776: Property School Tax Freeze Is a Wrong Move for PA

Pennsylvania, like every other state in the country, faces an unprecedented budget crisis at both the state and local...

read more

Calm Before the Storm: An Analysis of Governor Wolf’s Proposed Budget for 2020-21

We were in the last two weeks of work on this analysis of the governor’s proposed budget for the...

read more

Cutting Corporate Taxes Hasn’t Worked: Why PA Is Still Short on Necessary Funding – TESTIMONY

Click here for downloadable version.

read more

RELEASE: Corporate Tax Cuts Since 2002 Cost PA $4.2B Annually

Closing Delaware loophole, instituting worldwide combined reporting would level the playing field for small businesses and generate over $700...

read more

Corporate Tax Cuts Since 2002 Now Cost PA $4.2 Billion Yearly: Pennsylvania Should Pass Worldwide Combined Reporting

This paper focuses on the details of one part of this story: the cuts in corporate taxes in Pennsylvania since 2002 that have reduced revenues by what is...

read more