The PA Budget: A Disgrace and Dereliction of Duty

FOR IMMEDIATE RELEASE June 25, 2021 Contact: Adrienne Standley standley@pennbpc.org 717-805-8466 Statement by Marc Stier, Director, Pennsylvania Budget and...

read more

Cutting Corporate Taxes Hasn’t Worked: Why PA Is Still Short on Necessary Funding – TESTIMONY

Click here for downloadable version.

read more

RELEASE: Corporate Tax Cuts Since 2002 Cost PA $4.2B Annually

Closing Delaware loophole, instituting worldwide combined reporting would level the playing field for small businesses and generate over $700...

read more

Corporate Tax Cuts Since 2002 Now Cost PA $4.2 Billion Yearly: Pennsylvania Should Pass Worldwide Combined Reporting

This paper focuses on the details of one part of this story: the cuts in corporate taxes in Pennsylvania since 2002 that have reduced revenues by what is...

read more

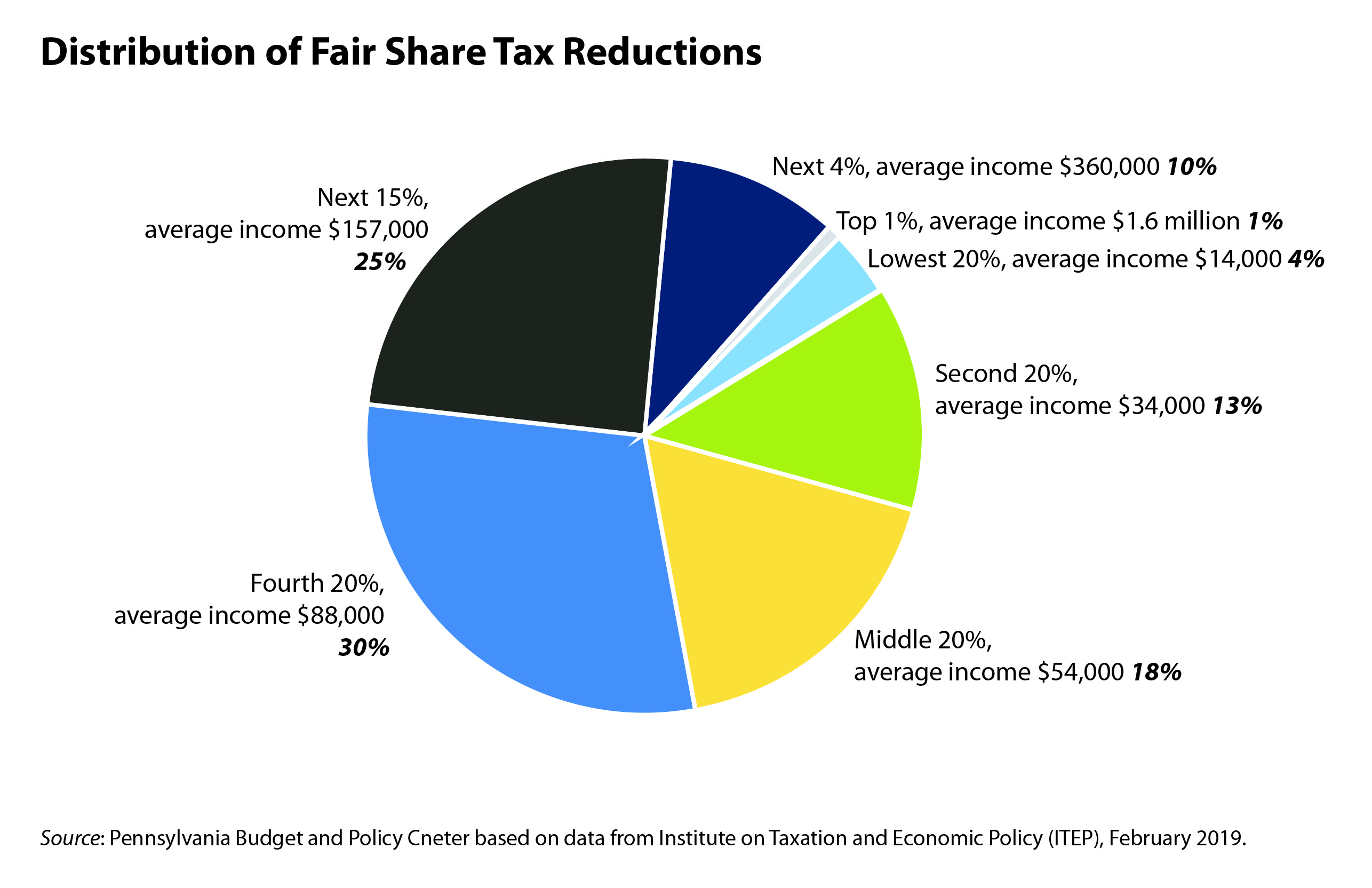

A Fair Share Tax Plan for Pennsylvania — 2019 Update

Read the full proposal here. This paper puts forward the Fair Share Tax plan, a major step toward fixing Pennsylvania’s...

read more

Corporate Income Taxes

read more

Memo: PA House Bill Won’t Close Tax Loopholes But Will Make Major New Business Tax Cut

House Bill 2150 presents a half-hearted attempt to close corporate tax loopholes with nearly a billion dollars in business...

read more

Special Interest Tax Break Will Cost $100 Million, Make Tax System Less Fair

Tom Wolf called on the governor and state Legislature today to reject a special interest tax break that will...

read more

Natural Gas Drillers Pay Little in Pa. State and Local Taxes

Natural gas drillers claim they have paid hundreds of millions of dollars in Pennsylvania taxes, but data from the...

read more

Under PA House Leadership Bill, Gas Drillers Would Pay One-Fifth of What They Pay in Texas

The Pennsylvania House may vote next week on a drilling fee plan that asks Marcellus Shale drillers to pay...

read more

STATEMENT: Senate Should Reject Program Notorious for Misuse in Other States

House Bill 2626 would provide profitable corporations a new tax credit just for filling a vacant position without creating...

read more

Reforming an Antiquated Sales Tax Perk for Big Retailers

Governor Tom Corbett proposes sales tax reform which limits vendor discounts for large corporations.This Reports and Briefing Papers concludes...

read more