This time of year, high school seniors are applying to colleges, and some are even beginning to hear back from the schools of their choice. And in the next few months, they will be weighing their options and trying to make smart choices.

Unfortunately for students in Pennsylvania, the hurdles (read: COSTS) are greater than for students in other states.

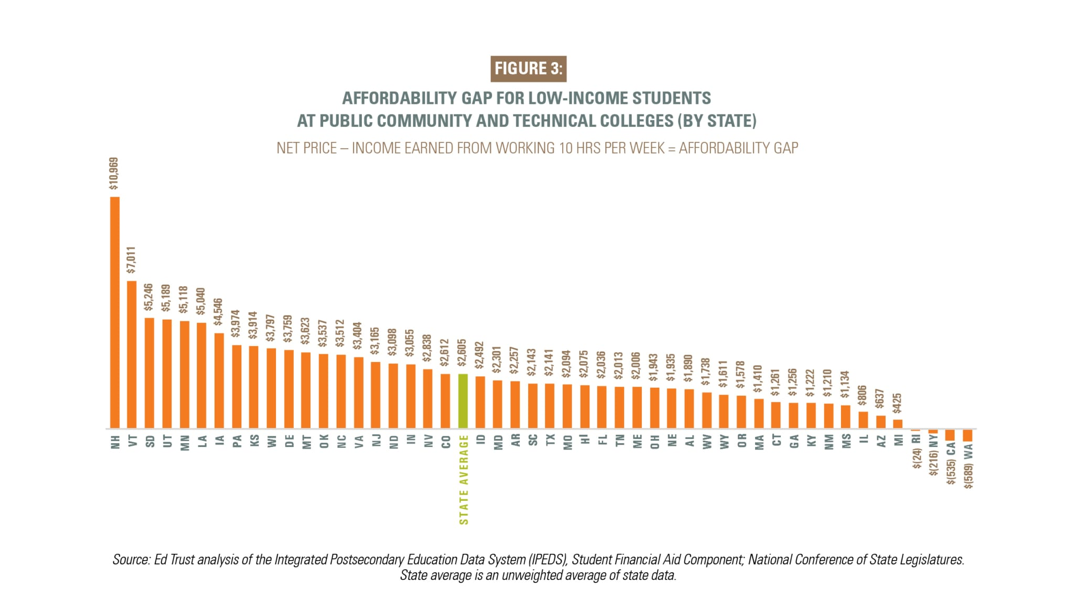

A new report from The Education Trust ranks states by what they call the affordability gap, that is, the net price of college (the average amount low-income students must pay after subtracting grants and loans) minus the income earned from working 10 hours per week at the state’s minimum wage.

Net price − income earned from working 10 hours per week = the affordability gap

The Education Trust uses the 10 hours per week time period because working many more hours beyond that can slow or stall a person’s ability to get a college degree. Too many work hours lessen students’ ability to focus on their schoolwork or the time to take enough classes to graduate on time.

Public four-year colleges are supposed to be more affordable options for those looking to get a good education—an alternative to private institutions without the same cost. However, public universities in Pennsylvania are anything but affordable.

Nationally, 15% of families earn less than $30,000 a year. For students in these families the average affordability gap is about $6,500 a year for public four-year colleges. In Pennsylvania, it is nearly double that at $12,331. In fact, only New Hampshire has a higher affordability gap.

While 10 hours of work per week in college is ideal, it would take more than a full-time job (44 hours per week) for a low-income college student to be able to afford college in Pennsylvania. And this is after factoring in the average aid package (grants and loans).

When considering public community and technical colleges by state, Pennsylvania fares better—but it’s no reason for celebration. At number eight, Pennsylvania still ranks in the top ten states for the highest affordability gap for these students. These schools tend to have a greater commitment to affordability and access than the state’s public 4-year universities, yet in PA the average low-income student faces a $3,974 affordability gap. In fact, Pennsylvania is one of only eight states where students attending these colleges must work for more than 20 hours per week to afford net costs (21 hours in PA), compared to the national average of 16 hours per week.

The Education Trust’s analysis focused on the lowest-income, full-time, degree or certificate-seeking students who come from families making less than $30,000 a year and receive federal aid. Even though these students have access to financial assistance, the affordability gap still looms large. Part-time, non-traditional, and undocumented students, as well as student parents, may have even less access to aid, making their potential affordability gap even worse.

So, what can Pennsylvania do to support students in the state?

First, Pennsylvania should raise the minimum wage to $15 per hour. If students were able to earn a $15/hour wage while in college, it would cut the hours they would have to work to pay for net costs. In Pennsylvania, rather than having to work 44 hours a week for 50 weeks out of the year, students at public universities would have to work 21 hours a week—not yet ideal, but it would go a long way towards helping low-income college students afford school. For students attending public community and technical colleges in Pennsylvania, a $15/hour minimum wage would decrease the number of hours needed to work year-round from 21 hours a week to just 10 hours a week—the ideal amount for college students.

Pennsylvania should also pass Pennsylvania Promise. PA Promise would cover the tuition and fees for any recent high school graduate enrolled full-time in a community college; cover four years tuition and fees at any State System of Higher Education university for recent high school grads whose family makes less than $110,000 per year; provide four years tuition and fees not to exceed state system tuition rates, depending on family income, for students going to a state-related university; and finance the expansion of grant assistance for adults seeking industry-recognized credentials.