The Build Back Better bill, which was recently approved by the House Ways and Means Committee, would make our tax system fairer by raising taxes on the top 5% of income earners in 2022 and cutting taxes for other income groups. It would raise $2.1 trillion over 10 years by raising individual income taxes on the rich and increasing corporate income taxes and taxes on tobacco and nicotine. The bill also includes significant tax cuts such as the expansion of the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC). These tax credits would offset tax increases for the average taxpayer and not the richest 5% of income earners.

A new report by the Institute on Taxation and Economic Policy (ITEP) breaks down the impact “Build Back Better” would have nationally and state-by-state. ITEP examines the main tax increases and cuts from this plan and examines how these changes would impact different income groups. There are four main tax changes in the bill:

- Income tax increases on individuals. This tax targets individuals with the highest incomes, which would mainly impact the top 1% of income earners, who earn an average of $1.8 million a year. This tax change would raise approximately $900 billion over the next ten years.

- Corporate tax increases. This tax would raise about $1 trillion over the next decade. About half of this would come from changing the corporate income tax rate from 21% to 26.5%. Remember, prior to the 2017 tax law, this rate was 35%. The rest of the $1 trillion would come from closing loopholes and eliminating special tax breaks, especially for those with offshore profits.

- Tobacco and nicotine tax increases. These increases would bring in about $97 billion over ten years by increasing the federal tax on cigarettes by a little over $1 per pack. This, unlike the other tax increases, would fall most heavily on low-income earners.

- The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) expansion. This expansion was implemented through the American Rescue Plan but will expire at the end of 2021. Expanding these tax credits would put more money into the hands of low- and middle-income people.

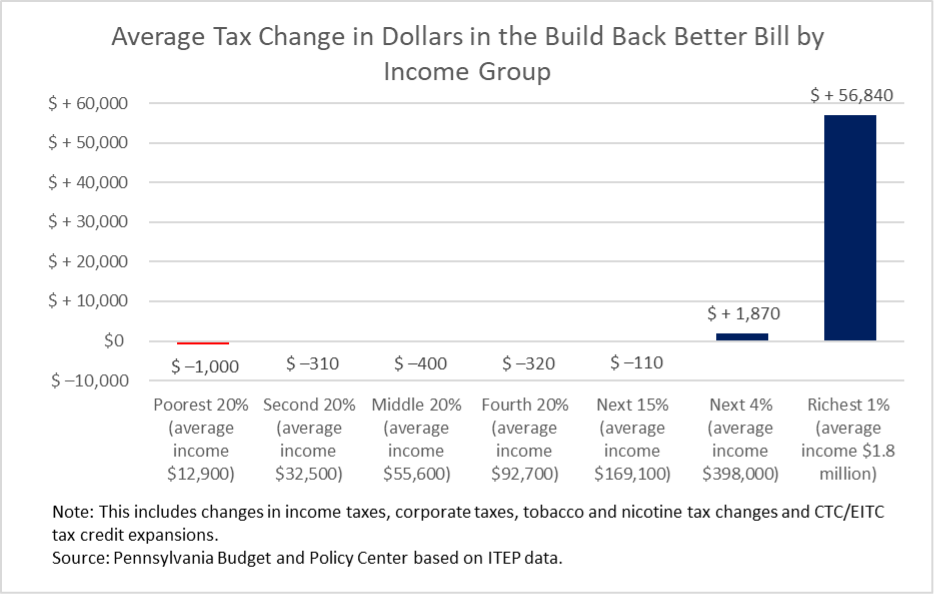

The combined impact by income group is shown in dollars in figure A below. When these four tax changes are considered, the poorest 20% of income earners—with an average income of $12,900 per year—would see a $1,000 tax cut. While not as extensive, those in the 20th to 95th percentile of income earners would also see a tax cut, on average, ranging from $110 to $400. The top 1% of income earners would see the largest tax increase—on average, an additional $56,840 per year.

Figure A:

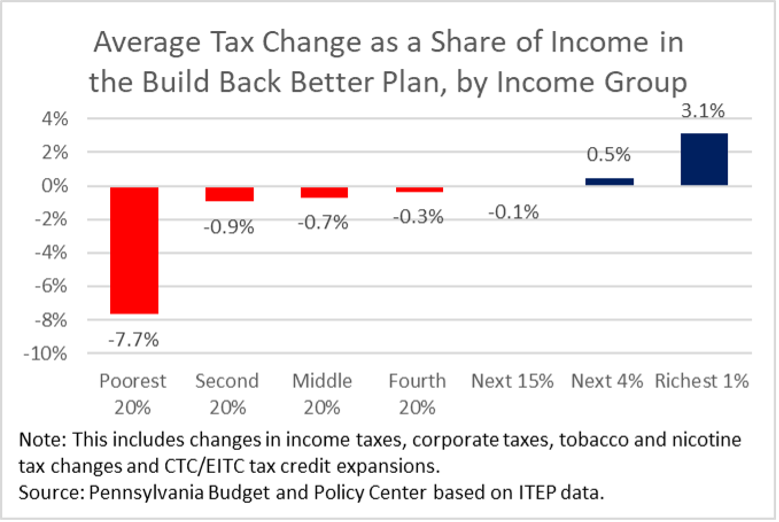

While $56,840 seems like a lot of money to most of us, remember that these increases are for individuals who make, on average, $1.8 million a year. As figure B shows, that is a tax increase of only 3.1% of the top 1%’s income. Conversely, the tax cut of $1,000 for the lowest-income workers may not seem like a lot—but given that this income group’s average income is $12,900/year, this tax cut would reduce their taxes by 7.7% of their yearly income, providing this population with a significant and much-needed increase in funds.

Figure B

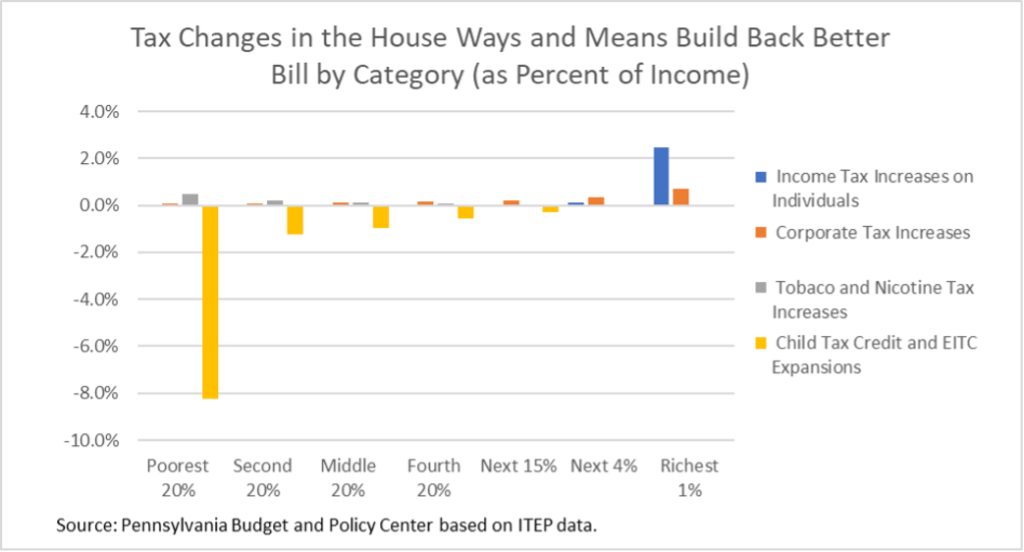

Below, figure C provides more detailed information on how each of the four major tax changes in the House Ways and Means Committee’s Build Back Better bill will impact each income group; the change is shown as a percent of income. As you can see, the Child Tax Credit and the EITC expansions benefit the lowest-income workers the most, but also middle-income workers (yellow). The tobacco and nicotine tax increases (grey) would increase taxes by $60 to $80 for all income groups, but obviously, as a percent of income, would have the greatest impact on lower-income individuals. However, these increases would be more than offset by the CTC and EITC expansions. Corporate tax increases would impact the top 20% of income earners the most—but the top 1% of income earners would only see a tax change of +0.7%. Income tax increases on individuals would only impact the top 1%, who would see an increase of 2.5%, and the next top 4%, who would see an increase of only 0.1% of their income.

Figure C

The Ways and Means bill would increase taxes on the top 5% of Pennsylvania’s income earners while providing tax cuts that go primarily to the bottom 95%. This bill would make our tax system more fair and progressive overall, providing relief to the poorest individuals while ensuring those with the most ability to pay are contributing more in taxes.