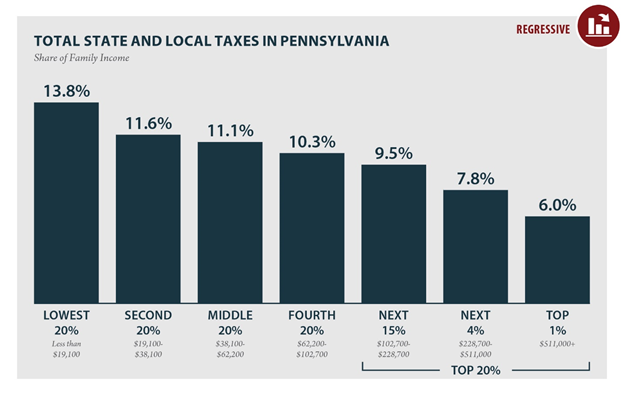

The Commonwealth once again claims its spot in the “Terrible 10” most unfair tax structures in the nation. The lowest 20% of income earners in the state pays more than double (2.3 times) their share of family income on state and local taxes than the top 1%.

Income inequality remains a growing problem in our state, as the top 1% earn on average 21.7 times that of the bottom 99%. While fixing our state’s growing inequality goes beyond tax policy, state tax structures can make things better and at the very least, not make them worse.

However, making inequality worse is just what Pennsylvania’s tax structure does. The Institute for Taxation and Economic Policy (ITEP) came out with the sixth edition of their annual report Who Pays? A Distributional Analysis of the Tax Systems in All 50 States. The primary question researchers at ITEP ask here is whether incomes are more equal, or less equal, after state taxes than before. Pennsylvania not only makes things worse for low- and middle-income earners, we rank seventh worst in the nation.

As the figure below shows, the lowest 20% (earning less than $19,100 a year) are paying 13.8% of their family income on state and local taxes—more than any other income group. In contrast, the top 1% (earning $511,000 and above) pay only 6.0% of their share of family income on state and local taxes.

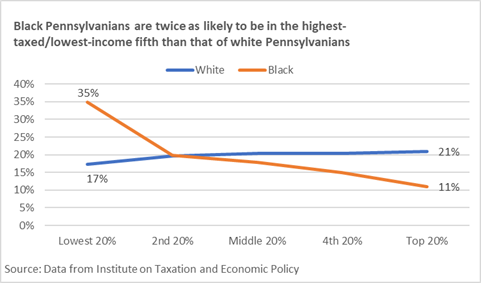

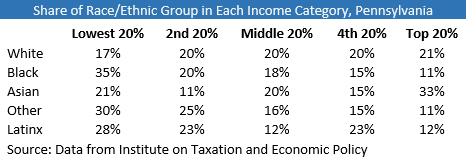

Pennsylvania’s tax structure is playing a role in worsening the racial wealth gap as well. As the figure below shows, Black Pennsylvanians are twice as likely to be in the highest-taxed/lowest-income fifth than white Pennsylvanians—35% of Blacks fall within the lowest 20% compared to 17% of whites. Latinx Pennsylvanians also have a higher likelihood (28%) of falling within this category and therefore facing higher effective tax rates.

ITEP includes state personal income taxes, property taxes and sales, and excise taxes in their calculations for each state. Sales and excise taxes are very regressive, meaning these taxes take a greater share from those with lower incomes because poor families spend a greater proportion of their income on goods that are taxed. Property taxes are typically somewhat regressive as well. The way that states typically make up for this regressivity is having an intentionally progressive personal income tax structure (those with higher incomes are taxed at a higher rate) so that the tax burden doesn’t fall so heavily on low-income individuals. Pennsylvania does not, and actually is one of only nine states that does not have a progressive personal income tax. Pennsylvania has a flat personal income tax rate of 3.07%, meaning all income is taxed at this same rate. We also offer no deduction or personal exemptions to reduce taxable income, nor do we provide refundable tax credits.

The major challenge to changing this in Pennsylvania is our constitution’s uniformity clause, which states that any class of income must be taxed at one rate, meaning a graduated or progressive personal income tax is not allowed.

However, we at the Pennsylvania Budget and Policy Center and the We the People campaign have a solution to this problem. The Fair Share Tax would divide our personal income tax into two separate taxes (so the uniformity clause is no longer an issue)—income on wealth which includes dividends, royalties, capital gains, business profits, etc. and income on wages and interest. Taxes on income from wages and interest would decrease from 3.07% to 2.8%, reducing taxes for 60% of Pennsylvanians who feel the effects of our current upside-down tax structure. Taxes on income from wealth would increase from 3.07% to 6.5%, with 60% of the tax revenue coming from the top 1%. This tax would raise $2.22 billion in new revenue in 2019-20 that can be invested in things like education, human services and protecting the environment—things that benefit all of us, not just the wealthy few.

Our state taxes should be structured in a way that raises needed revenue in the state and ideally decreases inequality. Instead our current system exacerbates existing income and racial disparities. There is a better way.