For two years, the COVID pandemic has shaped many aspects of Americans’ lives, including the health of our economy. Each new variant, and the resulting peaks then valleys of caseloads, leaves an unmistakable mark on the labor market and its recovery from the pandemic recession. With the release of the December 2021 job numbers for Pennsylvania, this blog provides an update on key economic indicators and the impact on them of the current omicron variant of the COVID virus, thankfully now ebbing.

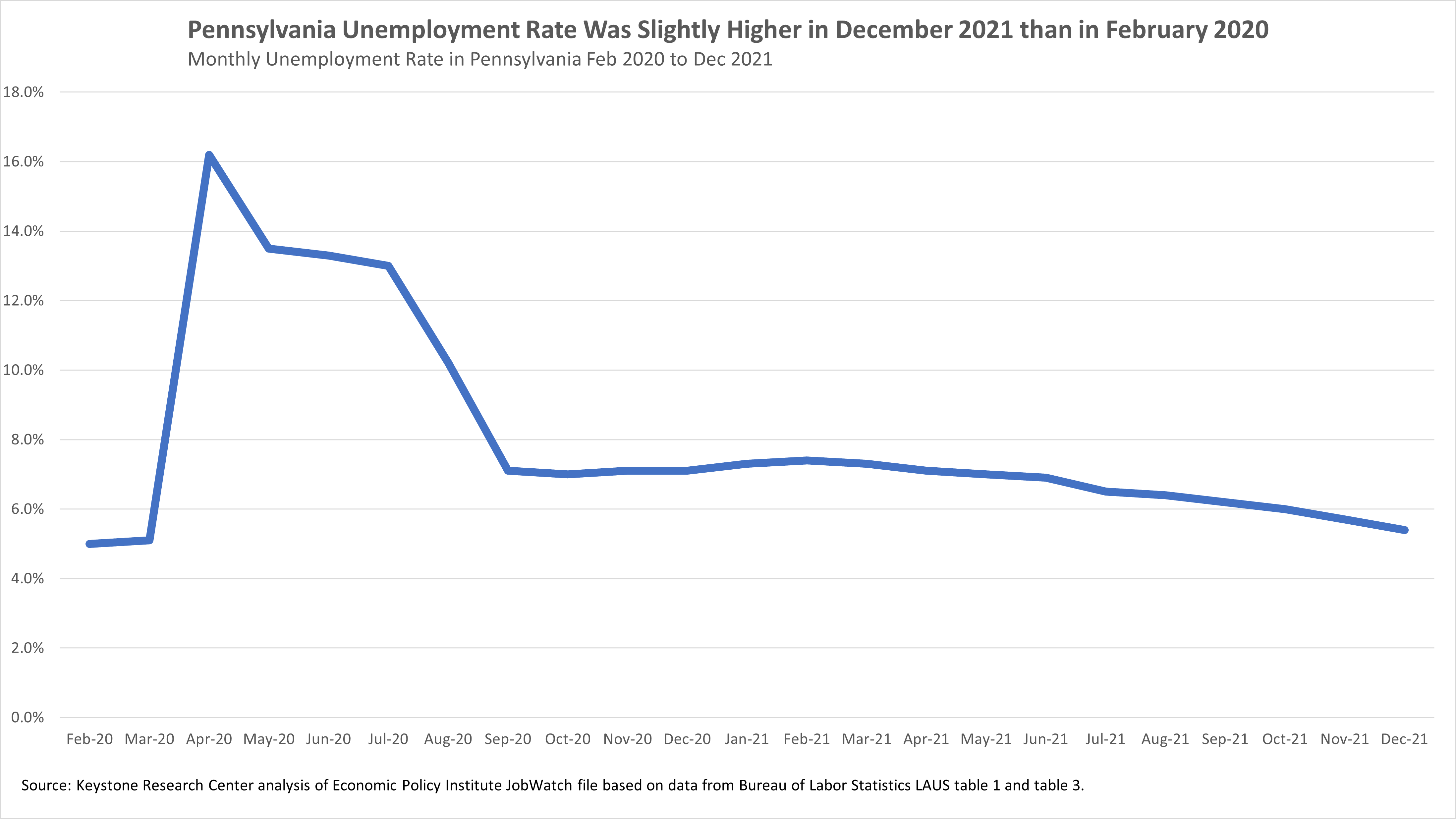

Pennsylvania’s Unemployment Rate Approaches Pre-COVID Level

Pennsylvania’s unemployment rate in December 2021 was 5.4%, 0.4% higher than February 2020. After hovering around 6.5% from September 2020 to summer 2021, it is no longer stagnant as it was for several months back in early 2021.

Figure 1.

As explained previously, the unemployment rate is an imperfect measure of the economy because many jobless people do not count as unemployed. We therefore rely on the total number of non-farm jobs to better gauge economic strength compared to pre-pandemic. Pennsylvania gained 14,000 jobs in December and 36,000 jobs over the past two months. The state, however, remained nearly 300,000 jobs (288,000) shy of the February 2020 level in December.

Figure 2.

In addition to Pennsylvania, forty-five other states remain short of the February 2020 level.

Another indicator of the job market is the Pennsylvania labor force participation rate—i.e., as defined by the Bureau of Labor Statistics, the share of the civilian, non-institutional population 16 and older that is working or actively looking for work. Like the number of non-farm jobs, this remains well short of February 2020 levels: 60.8% in December 2021 down from 63.5%.

Impact on Employment by Industry

Figure 3 shows the jobs deficit compared to pre-pandemic in specific industries. The low-wage leisure hospitality industry was far and away the hardest-hit industry in Pennsylvania. Rapid job growth in the Pennsylvania leisure and hospitality industry in October gave way to slower job growth in November and December as virus caseloads rose again. Pennsylvania leisure and hospitality remains 89,000 jobs short of the February 2020 level.

The construction industry is now the industry with the second-largest percent drop-off in jobs since pre-pandemic, 7.8. Since April 2021, there has been a decline of about 8,000 construction jobs in Pennsylvania on a seasonally adjusted basis, over 3%. This could partly reflect supply chain problems—shortages of building materials and now of workers—as this U.S. Chamber article noted last September. With infrastructure dollars likely to start flowing soon in the non-residential segment of the construction industry, Pennsylvania needs a plan to expand the pipeline of new construction workers. Anticipated construction demand combined with retirements among the current workforce create an unprecedented opportunity to provide lower-wage and diverse workers without a college degree in Pennsylvania with a pathway to high-paid union construction jobs.

Figure 3.

As before, high-wage financial services, in which working from home is an option for many workers, remains one of the industries with employment closest to pre-pandemic levels. The industry with employment closest to pre-pandemic levels is trade, transportation, utilities. This likely reflects the expansion of distribution linked with online retail—Amazon and the like.

Sustain Demand, Improve Jobs

December’s job numbers make clear that the economy remains short of the pre-pandemic level of activity. This partly reflects the dogged persistence of the COVID virus, which keeps many businesses closed or only partly open and leads many workers to have to stay home because of a lack of childcare and/or fear of increased infection on the job.

Even should the virus finally recede over the next few months, two other factors threaten economic progress. First, as noted in “The State of Working Pennsylvania 2021,” much of the assistance for families from the American Rescue Plan has run out (e.g., expanded unemployment benefits in September 2021) or will soon run out (the child tax credit, rental assistance in some communities). State investment of the $7.5 billion in American Rescue Plan dollars sitting in Harrisburg—e.g., in education, assistance for small business, and support for low-income families—could help avoid flagging demand later in 2022. In addition, improving jobs could make it worthwhile for more workers to return to the job market. The obvious way to improve a million or so low-wage jobs in Pennsylvania would be through a big increase in the Pennsylvania minimum wage.